- Biweekly mortgage calculator with extra payment option how to#

- Biweekly mortgage calculator with extra payment option full#

- Biweekly mortgage calculator with extra payment option free#

If bi-weekly payments save so much money, why doesn’t everyone use them?

Biweekly mortgage calculator with extra payment option free#

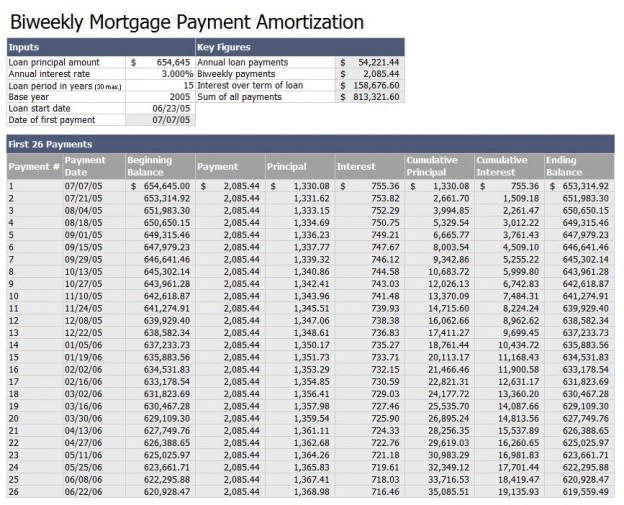

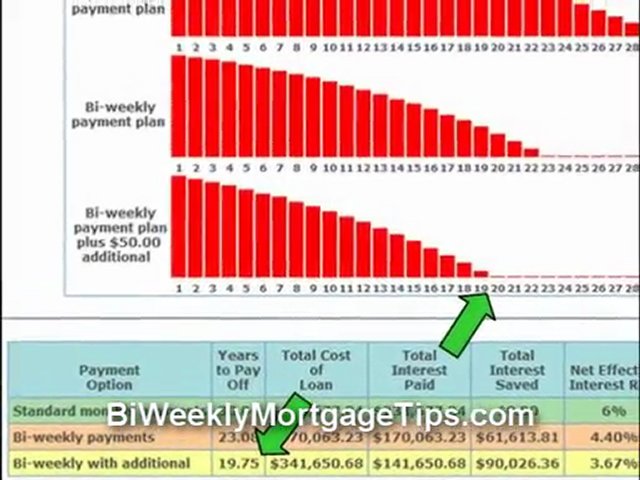

This means the debt will be fully paid off within 21.5 years instead of 25, netting you a $14,610 saving on interest payments! You can click "Get FREE Quote" now to find local providers offering this option and enjoy some major savings on your home loan. Over the course of a year you will make 26 payments of $350.76, totalling $9,120 – whereas with 12 standard monthly payments you would pay only $8,418. A bi-weekly payment would be half of that = $350.76. Are in a strong enough financial position to make an extra payment each year.įor example, a fixed-rate mortgage of $120,000 at 5% interest over 25 years will require a monthly repayment of $701.51.Want to compare the amount of interest you will pay between monthly repayments and bi-weekly payments.Are considering a bi-weekly payment plan and would like to establish how much you stand to save.The Bi-Weekly Payment Calculator is most useful if you: Click View Report for a breakdown of your potential savings.

Choose from the drop-down whether you would like to calculate your savings based on a weekly or bi-weekly payment plan.Choose the number of years you plan to take to repay your mortgage.Enter the amount you are borrowing on your mortgage.Input your mortgage rate by using the slider or simply typing it into the box.Not sure where to start? Let us help you:

Biweekly mortgage calculator with extra payment option how to#

How to use the Bi-weekly Payment Calculator This calculator also displays the length of time it will take to repay you loan and the total interest that you will pay on a bi-weekly payment schedule compared to a monthly mortgage payment. When you click View Report, the calculator will show a comparison between your monthly payment and the proposed bi-weekly payment. Making one extra payment each year can shave years off your mortgage and save you thousands of dollars in interest – our calculator can tell you exactly how much you stand to save. The bi-weekly payment calculator will help you to calculate the amount of money that you will save by paying your mortgage on a bi-weekly basis instead of a monthly basis. Why use the Bi-weekly Payment Calculator? The most common terms for mortgages are 15 years and 30 years. The number of years over which you would repay this loan if you made your normal monthly payment. Click the view report button to see all of your results. This is mutually beneficial to the lender and the borrower the lender gets an extra payment each year and the borrower not only repays their debt faster, but repays significantly less.īy changing any value in the following form fields, calculated values are immediately provided for displayed output values.

Biweekly mortgage calculator with extra payment option full#

Therefore, over the course of one year, you will have made 13 full payments – one more than if you were paying monthly. This means that you pay equal to one full payment every four weeks. With bi-weekly payments, you repay half of your normal monthly payment every two weeks, instead of every month. Making bi-weekly payments on your mortgage greatly reduces the time it takes to fully repay your loan, and significantly reduces the total amount of interest paid. Regardless of the type of mortgage, borrowers usually have the option to prepay on the principal balance of the mortgage in order to pay off the mortgage faster than the established term of the mortgage. ICB Solutions | NMLS #491986 ( Close Modal Mortgage products are not offered directly on the website and if you are connected to a lender through, specific terms and conditions from that lender will apply. will not charge, seek or accept fees of any kind from you. By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you. For a full list of these companies click here. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request. ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes. Neither, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency.

ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. is a product of ICB Solutions, a division of Neighbors Bank.

0 kommentar(er)

0 kommentar(er)